LEARNING

Automated Forex Trading

✨ StrategyQuant Review

StrategyQuant is a sophisticated platform that enables traders without programming skills to create, optimize, and backtest advanced automated trading strategies from scratch. It represents the next logical step in the evolution of automated trading.

♕ StrategyQuant Review: The Evolution of Strategy Building

StrategyQuant users can create or find pre-made automated strategies to trade any financial market (Forex, Equities, Metals, Soft Commodities, etc.). The trader simply selects a market and timeframe, and StrategyQuant begins generating automated strategies. The trader can then choose the best-performing strategies, as well as test and optimize them against randomness.

□ StrategyQuant operates in four (4) modes: building, re-testing, improvement, and optimization

□ Building (from scratch) and optimizing automated trading systems for every financial market

□ Generating and testing thousands of random automated strategies (within hours)

□ Applying automated data-mining algorithms to generate EAs for MetaTrader4, TradeStation, and NinjaTrader platforms

□ The StrategyQuant 14-day trial version fully functional and it is not limited compared to the full package

📊 Quantamental Trading Approach

Quantamental is a new trading approach that combines quantitative and fundamental analyses to forecast future market conditions. Trading and data mining are expected to converge in the near future.

In general, forecasting is the process of predicting future market conditions based on past and present data, as well as the analysis of key trends. All forecasting methods can be divided into two broad categories:

(i) Quantitative methods, based on mathematical models, and

(ii) Qualitative methods, based on educated guessing.

(1) Quantitative Forecasting

(2) Fundamental Analysis

Fundamental analysis is a method of valuing a financial instrument by examining and evaluating all relevant internal and external factors. These factors include financial, economic, social, political, strategic, and other quantitative and qualitative variables. The goal of fundamental analysis is to determine a 'fair value' that can be compared with the current market price.

Fundamental analysis uses a wide range of real data—such as macroeconomic indicators, industry analysis, balance sheets, earnings reports, and key data releases—to assess the value of a financial instrument.

While fundamental and quantitative analyses differ in core ways, they also share many similarities. For example, when evaluating shares, both methods consider market capitalization, sector classification, price/earnings ratio, and dividend policy. As a result, quantitative models can be used to optimize the outcomes of fundamental analysis.

⚙ Free MT4, MT5 Expert Advisor Builders

⚙ Free MT4, MT5 Expert Advisor Builders

Automated Forex Trading is considered the 'Holy Grail' by many Forex traders. The following EA builders can be used to create EAs for MetaTrader 4 and MetaTrader 5 and are available either for free or with a free trial period

MT4 builders are designed to generate customized Expert Advisors by compiling MQL4 or MQL5 code. Some of the following EA builders are web-based, while others require installation. When creating your first customized EA, it is recommended to test it risk-free on a Demo Account before trading with real money.

Here are the free Expert Advisor builders:

(1) EA Builder for MT-4, MT-5, and Tradestation

◙ PRICE: Free for creating Indicators

◙ PRICE: Free for creating Indicators

◙ BUILDER: Web-Based App

◙ EXPERIENCE: Semi-Advanced / Advanced Traders

The EA builder is a free application for creating indicators. It allows you to transform your manual trading into arrows and alerts, and to create indicators for MT4, MT5, and TradeStation. You can also convert any manual system into a fully functional Forex Robot (EA).

Here are the basic features of the EA Builder:

- Develop custom indicators and EAs for trading Forex pairs, stocks, indices, ETFs, commodities

- Create EAs without knowing anything about programming

- Tens of built-in functions such as support, resistance, trendlines, and time (select when to trade)

- Every feature of the EA Builder has a popup tip that helps and guides you

- Three (3) Alert Types (eMail, Audible alerts, print to output window)

- Full Money-Management system with custom functions

- The generated code is contained in a single file, ready to be used on MT4, MT5, or Tradestation

EA Builder is completely free for creating indicators, but if you want to create EAs, a one-time payment is required.

Here is the website of EA Builder:

» Find here the EA Builder for MT4 & TradeStation

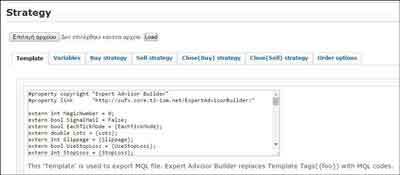

(2) Expert Advisor Builder for MetaTrader 4

◙ BUILDER: Web-Based App

◙ EXPERIENCE: Semi-Advanced / Advanced Traders

The Expert Advisor Builder (EAB) is a web-based EA builder that is free and easy to use. EAB creates EAs for MT4 using seven (7) input fields.

(i) EA Template field

In this section, you may enter your own script.

(ii) EA Variables field

In this section, you will set up your main variables according to which you will control your trading strategy {Buy and Sell strategy / Close(Buy and Sell) strategy}.

(iii) EA Buy-Strategy field

Set up your EA buy strategy.

(iv) EA Sell strategy field

Set up your EA sell-strategy.

(v) EA Closing (Buy) strategy field

This section allows you to enter the conditions for Closing Positions opened according to the 'Buy strategy' field.

(vi) EA Closing (Sell) strategy field

This section allows you to enter the conditions for Closing Positions opened according to the 'Sell strategy' field.

(vii) EA Order Options field

Set up some extra settings for your Expert Advisor.

Here is the website of the Expert Advisor Builder (EAB):

» http://sufx.core.t3-ism.net/ExpertAdvisorBuilder

Welcome to ForexRobots.net

Automated trading demands seamless integration of strategy, technology, and execution -requiring powerful hardware, advanced trading software, and a low-latency Forex broker that ensures fast execution and minimal slippage.

Automated trading demands seamless integration of strategy, technology, and execution -requiring powerful hardware, advanced trading software, and a low-latency Forex broker that ensures fast execution and minimal slippage.

🔗 Learning

Trading Reviews

💼 Review Brokers

Review ECN/STP Forex brokers that support automated trading and scalping, offering tight spreads, fast execution, a broad range of currency pairs, and—most importantly—robust fund security.

📈 Auto Trading with RoboForex

Offering tight spreads, low slippage, and a free VPS hosting..

🔔 Forex Trading Signals

Professional-grade Forex trading signals without the high cost.

Compare Brokers

ForexRobots.net provides thorough Forex broker comparisons, highlighting trading costs and platform-specific features. Focusing on ECN/STP order execution, known for delivering fast execution and low slippage – features critical for successful automated trading.

⚖️ Choosing the right broker for auto-trading and scalping..